Key points to remember: the the success of setting up in Dubai is based on the trade-off between between Freezone and Mainland, two structures that now allow foreign ownership of 100%. This strategic choice defines the commercial perimeter and the liability of 9% to the new tax, with an administrative entry fee of between AED 6,000 and AED 20,000 depending on the jurisdiction chosen.

Are you wondering how to set up a company in Dubai without getting lost in the local administrative maze or risking costly penalties? This practical guide details every stage of the process, from the strategic trade-off between Freezone and Mainland to managing new tax realities such as Corporate Tax. Get ready to master the rules of the game so you can launch your business in the Emirates with speed and peace of mind, by avoiding the pitfalls that await ill-informed entrepreneurs.

For the majority of foreign entrepreneurs, Freezone is the logical first choice. It is an option that guarantees foreign ownership to 100 % while offering administrative simplicity that you won't find elsewhere. You can avoid red tape and concentrate on what's important.

This status clearly targets specific sectors: consultancy, tech and international e-commerce. But there is one major obstacle to be aware of: you will not be able to trade directly on the local Emirati market without going through a third-party distributor. This is a strict legal barrier.

In short, it's the the quickest structure to assemble if your business model does not depend on customers physically based in the Emirates.

If your ambition is to reach the whole country without barriers, Mainland is the only serious option. It gives you a direct, unlimited access to the entire Emirates market, without any intermediaries.

The situation has changed: local sponsorship is no longer an obligation, which means that we can finally 100 % foreign-owned for the vast majority of commercial activities. This structure offers far greater credibility with local banks and government institutions, which are often suspicious of free zones.

But don't underestimate the investment: the start-up costs are higher and the administrative procedures more cumbersome than in Freezone.

Let's be clear about the Offshore structure: it's a option to be avoided in 2025. With the drastic tightening of AML/CFT (anti-money laundering) standards, opening a bank account has become an ordeal, not to mention the total absence of a residence visa.

Freelance status may seem an attractive way to start out, but its limitations will soon catch up with you: low credibility with major clients and the legal impossibility of taking on staff. It's a solution for solopreneurs, not to build an empire.

That said, for some very specific solo activities, you can consult the freelance status in Dubai, which remains a viable entry point before moving on to a full-fledged company.

This table will help you to visualise the fundamental differences so that you don't take the wrong route. We've made it easy for you to making the right choice.

| Criteria | Freezone company | Mainland Company | Freelance status |

|---|---|---|---|

| Property | 100% foreign | 100% foreign (for most activities) | N/A (individual) |

| Market access | International and UAE via distributor | Full access to the UAE market | Local and international (services) |

| Cost of creation | Moderate (from AED 6,000) | High (from AED 12,000) | Low |

| Residence visa | Yes | Yes | Yes |

| Ideal for... | E-commerce, consulting, international trading | Local commerce, catering, construction | Consultants, coaches, creatives |

Your final choice depends entirely on the nature of your project and your ambitions. It's up to you!

Once the structure has been chosen, the path becomes clearer. Now let's take a look at how the setting up your business in Dubai.

It all starts with a precise definition of your business activities. This strategic choice will determine the type of licence required and sometimes even the most suitable free zone for setting up a company in Dubai.

Do you want to avoid administrative delays? Careful preparation of your documents in advance remains the absolute key to guarantee a smooth process.

Your complete file is then submitted with the relevant authority. This is done either with the authority of the chosen free zone, or with the DED (Dubai Department of Economic Development) for a Mainland company.

Let's move on to choosing a trade name. There are several options to choose from. The name must comply with certain strict rules, such as the absence of offensive terms or religious references, and must be formally approved by the authorities.

Once your name and activities have been approved, the authorities will issue an invoice for the licence fee. This is the signal that your file is validated.

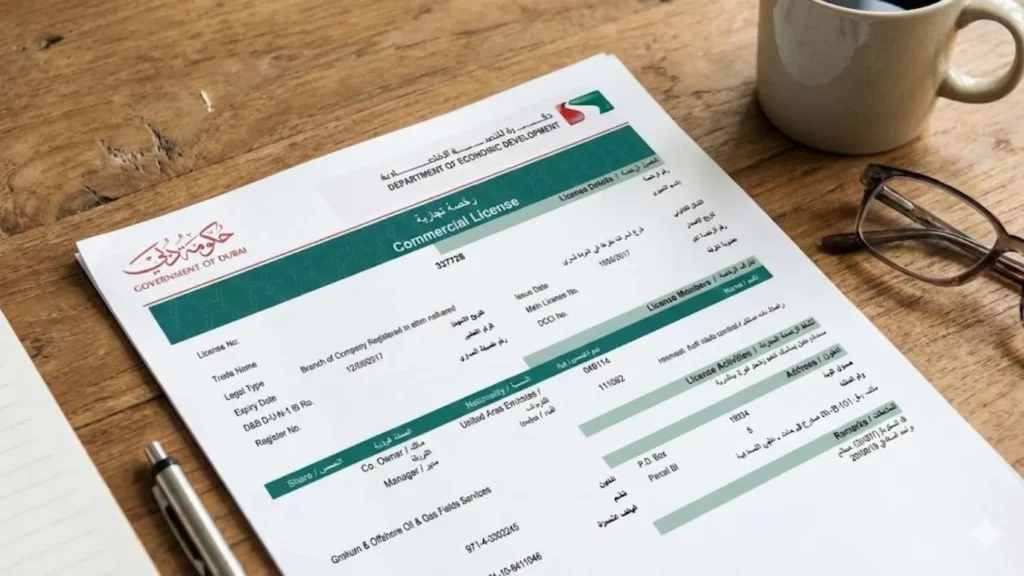

Once payment has been made, the commercial licence is issued. This is the official document, the sesame that legally authorises you to operate on the market.

For a Freezone, this process is fast and can take between 5 and 10 working days if the application is complete.

Please note that obtaining a degree is not the end of the process. Rather, it is the the real start-up phase of the company.

Here are the next steps: applying for a visa, obtaining an Emirates ID, and opening a bank account. Follow the post-creation stages to become fully operational.

Now that the skeleton of your project has been defined, let's talk about the element that will bring it to life: commercial licence.

Many people think that all you have to do to set up a company in Dubai is register. Not so. A business licence is not just a standard piece of administrative paper. It is the real sesame that authorises you legally to operate, and its type depends strictly on the real nature of your business.

Do you trade, buy or resell goods? Then you should aim for the commercial licence (Commercial License). This is the most common for traditional trading activities.

If your added value is based on intellectual skills or know-how, opt for a professional licence (Professional License). It is specifically targeted at consultants, tradespeople and the self-employed.

For those who manufacture, assemble or transform raw materials, an industrial licence is required. It is required for any production or assembly activity on Emirati soil.

Note that some regulated sectors require specific authorisations. This is the case for Bachelor's degree in tourism or e-commerce, These are essential if you are to operate legally in these areas.

Choosing the right licence is a technical stage where mistakes can be costly. Choosing the wrong category can lead to an inability to practise or to heavy fines. See here, the expertise of an advisor avoids many pitfalls.

Le submission of the application varies depending on your jurisdiction. In a Freezone, you deal with the zone authority. For a Mainland, it's the Dubai Department of Economic Development (DED) that manages everything.

Once your documents and business plan have been submitted, a approval phase begins. The authorities carefully check that your project complies with local regulations before approving it.

Once the green light has been given and payment made, the official document is finally issued. Your company exists legally. You can now bill and operate with complete peace of mind.

Once you have your degree, one question remains central: how much will all this cost? ? Let's be clear and talk figures.

Let's get down to the nitty-gritty, but necessary subject. If you opt for a Freezone creation, the average budget is between AED 6,000 and AED 15,000. This amount generally includes the licence itself and the administrative registration fees required to get started.

The situation changes if you are targeting the local market. To set up in the Mainland, you need to provide a more substantial budget, These range from AED 12,000 to AED 20,000. The entry ticket is higher, but this is the price of direct access to the Emirati market.

Beware of discount offers that flood the web. An abnormally low price often conceals additional costs or incomplete services that will cost you later. Visit price transparency is your best indicator of reliability.

It's a classic mistake to think that spending stops when you create your business. You need to anticipate annual renewal fee of your licence. This is an unavoidable fixed cost that you should factor into your budget planning now to avoid any unpleasant surprises.

There are also other costs. You have to finance the renewal of your residence visa every two or three years, as well as the compulsory rental of an office or «flexi-desk».

Finally, tax compliance should not be overlooked if you want to set up a company in Dubai on a long-term basis. Accounting and reporting costs (VAT, Corporate Tax) have become standard. These compliance costs will protect against much heavier fines.

Do you really have to pay for assistance with these procedures? The answer is yes, without the slightest hesitation.

The fees of a firm of experts are not a simple expense, but a significant a genuine investment in safety and speed of your project. They know the local subtleties that you may not be aware of.

This initial investment saves you precious time and avoids costly administrative errors. That's the price of invaluable peace of mind so that you can concentrate solely on developing your business.

Our advice: Avoid over-attractive offers and take an overall view of your budget. Professional support is an investment that will make your project more secure and avoid hidden extra costs.

Forget the myth of «zero tax» that was circulating ten years ago. Dubai has modernised its tax system, It is vital to understand the new rules of the game to avoid any nasty financial surprises.

Corporate tax radically changes the local landscape for entrepreneurs. It is a direct tax on the profits made by your business. Fortunately, the rate remains locked at 0% on the first AED 375,000 of annual net profit.

However, for the portion of profits that exceeds this threshold of AED 375,000, the State now applies a "tax on profits". 9% rate. This percentage only applies to the surplus generated. This remains extremely competitive worldwide.

Make no mistake, this applies to all companies, even those in Freezone. You must register with the Federal Tax Authority (FTA). This is a compulsory step if you want to set up a company in Dubai in good standing.

VAT has become part of everyday business life here. The rate is set at 5% on the vast majority of goods and services sold in the UAE.. This is a classic consumption tax.

Here's the golden rule to avoid breaking the law. L’VAT registration is mandatory as soon as your company's annual turnover exceeds AED 375,000. Keep a close eye on this figure.

This involves collecting VAT from your end customers. You will then have to declare it periodically and pay it to the State. Rigorous accounting is therefore essential to avoid penalties.

Don't panic, Dubai's main attraction has not disappeared with these reforms. Despite the recent arrival of Corporate Tax, one major advantage persists for entrepreneurs. That's what makes all the difference.

There is still no personal income tax in Dubai. The salaries and dividends you pay yourself are not taxed at all. Everything you earn personally remains yours.

This absence of taxation on personal income remains one of the pillars of the’Dubai's appeal. It's the number one argument for entrepreneurs the world over. Your personal assets are protected and maximised.

Your structure is registered and the tax framework is in place, but the work is not finished. To really set up a company in Dubai and operate there, there are still two concrete stages separating you from the final objective.

Having a commercial licence is the absolute prerequisite for obtaining a residence visa. This sesame is not obtained automatically after registration; you have to make a specific request. This is the key stage in validating your presence.

This official document is directly linked to your status as an investor or company director. It will legally entitled to live in the United Arab Emirates over the long term. Without it, you're just another visitor.

You will need to undergo a quick medical examination and have your biometric data collected on site. These formalities unlock your Emirates ID, the essential local identity card. This is your pass for all services.

Many entrepreneurs think it's a simple administrative formality, but that's a big mistake. Opening a business bank account has become a necessity. the strictest and most complex stage in Dubai. If you underestimate it, you risk blocking your entire business.

Local banks are subject to particularly stringent KYC/AML compliance rules these days. They require solid evidence to validate the economic legitimacy of your business. They no longer take no unnecessary risk.

A poorly prepared application or a vaguely defined activity almost always leads to a refusal. This is where a expert with the right banking connections changes the game radically. Don't go it alone on this one.

Your own residence visa entitles you to the invaluable right to «sponsor» your immediate family. This usually involves your spouse and children, so that they can join you. The family often remains the priority of the project.

This is a separate administrative procedure, but it depends entirely on the validity of your own status. It will allow them to’obtain their personal residence visa to settle in permanently. Everything is linked to your main file.

You should know that minimum income conditions apply generally to validate this family sponsorship. This is a critical point to check when structuring your expatriation project. Anticipate these criteria to avoid unpleasant surprises.

Many people think that obtaining a licence marks the end of the road. Not so. You need to prove the economic substance of your entity. Clearly, the authorities want to see real activity in the UAE, not an empty shell or a simple «mailbox».

In practical terms, this requires a physical workspace, even a flexi-desk, local expenses and employees. Effective management must be based in the United Arab Emirates. to validate your structure.

It's not a question of zeal, it's a question of requirement of international standards (OECD) convention against tax evasion. The Emirati authorities are very attentive to this, so don't overlook this fundamental aspect.

The work doesn't stop once you've obtained your licence - quite the contrary, vigilance remains the order of the day.

Failure to comply with these obligations will result in heavy financial penalties and may lead to suspension of the licence. You risk a lot for a simple administrative oversight or negligence.

Managing compliance can quickly become a full-time job for an executive. It is a major source of stress that distracts entrepreneurs from their core business and hampers growth.

The logical solution is to delegate this monitoring to trusted professionals. Firms like Clemenceaugroup offer accounting, tax and legal secretarial services to free your mind.

This is the best way to secure your investment over the long term. This ensures that your plans to set up a company in Dubai remain perfectly compliant, today and tomorrow.

Launching your business in Dubai is a an exceptional strategic springboard, But you need to master the rules of the game. Between legal choices and tax compliance, there's no room for improvisation. To turn this project into a lasting success without wasting time, expert support remains your best asset to secure your investment.

The budget varies considerably depending on the legal structure chosen. For a company in a Free Zone, the start-up cost is generally between AED 6,000 and AED 15,000. If you opt for a Mainland company, budget between AED 12,000 and AED 20,000. Bear in mind that these amounts cover basic administrative costs; you will often need to add the cost of visas and office rental.

Dubai offers exceptional business environment with a tax advantage (no personal income tax) and first-class logistics infrastructure. It is a strategic gateway to the markets of the Middle East, Africa and Asia. What's more, political stability and legal certainty reassure foreign investors.

Since the introduction of the new tax system, a corporation tax of 9 % applies. However, this tax only applies to profits in excess of AED 375,000 a year. Below this amount, the rate remains at 0 %. It is important to note that registration with the tax authority is compulsory for all businesses, regardless of their turnover.

Yes, it's quite possible. In the Free Trade Zones, the foreign ownership at 100 % is the standard for a long time. As far as Mainland companies are concerned, recent reforms have removed the requirement to have a majority local sponsor for most business activities, allowing foreign investors to hold 100% of the capital.

The cost of an offshore company is attractive, often between AED 8,000 and AED 15,000. However, this structure is now highly inadvisable for most contractors. It does not allow you to obtain a residence visa, does not authorise any commercial activity on Emirati soil and makes it extremely difficult to open a business bank account because of anti-money laundering standards.

As well as setting up your own business, you need to budget for your personal installation. You should expect to pay around AED 7,000 to 8,000 per residence visa. The cost of living and accommodation varies from one area to another, but it's a good idea to have some money in your budget. overall budget of at least AED 50,000 (around €12,500) to cover the cost of setting up the company, visas and the first few months' rent and running costs.

Legal structure, licence, real budget, visa, bank account and pitfalls to avoid. Download the complete guide to setting up your company in Dubai with peace of mind.

✨ EXPATRIATION TO THE UAE GUIDE

Do you have any questions about setting up a company in Dubai?

Find all our guides to setting up a company in Dubai and the United Arab Emirates.

Download the guide

Download the free guide and prepare your expatriation to Dubai with a clear, step-by-step method.

"*" indicates required fields